Receivables Automation

Automate collection procedures in your enterprise

Receivables automation streamlines the entire order-to-cash cycle, ensuring businesses get paid faster and with fewer errors. In a connected financial network, it acts as the critical link between sellers and buyers, automating invoice generation, tracking payments, reconciling transactions, and reducing disputes. This automation minimizes manual intervention, accelerates cash flow, and improves overall financial predictability.

By integrating with e-invoicing frameworks, ERP systems, and banking networks, receivables automation eliminates delays and enhances visibility, ensuring businesses maintain healthier liquidity.

AR Automation

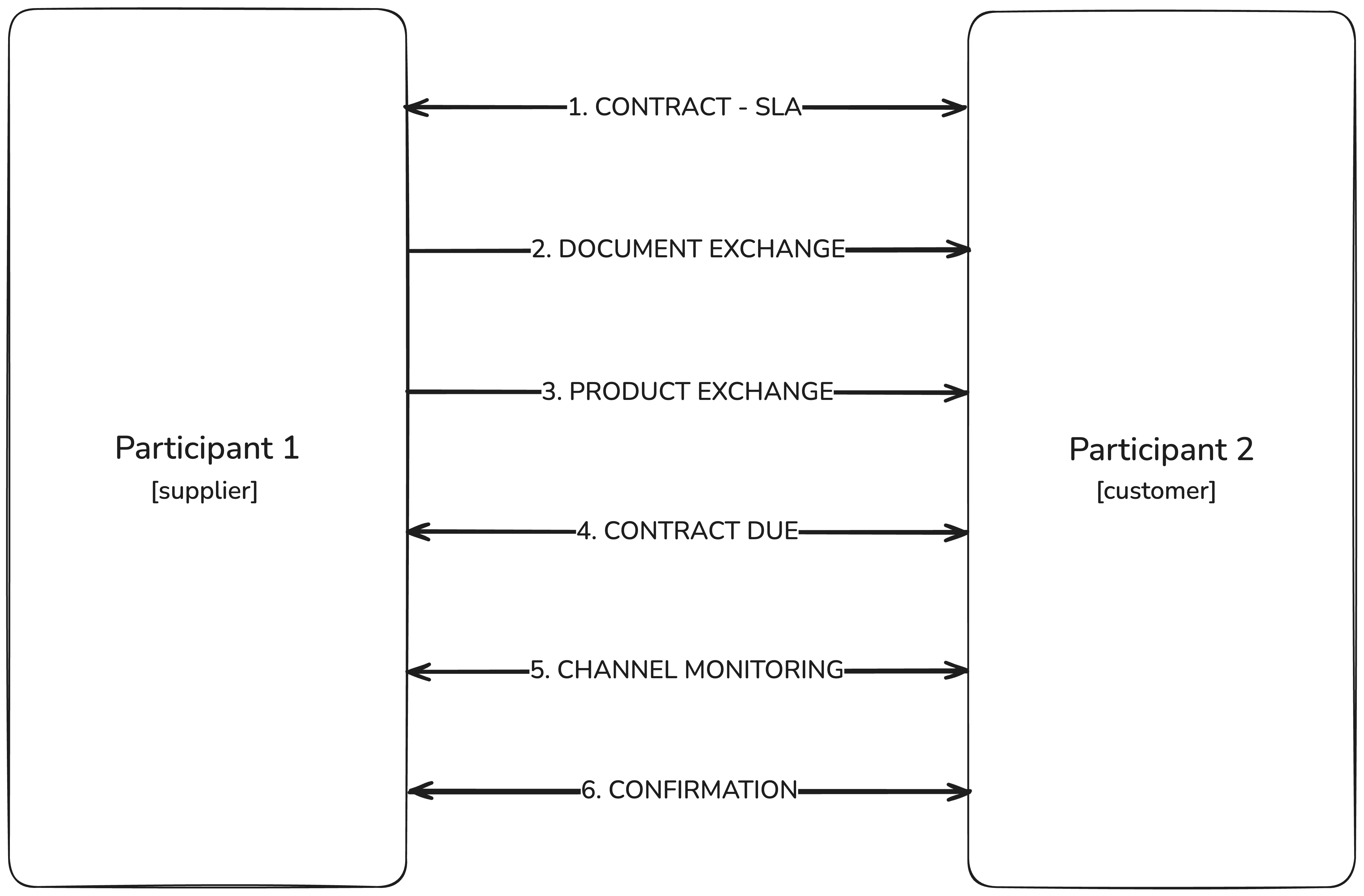

Our Network transforms Accounts Receivable (AR) Automation by creating a structured digital ecosystem where businesses can enforce contracts, exchange documents, track payments, and ensure compliance—seamlessly across participants. Our APIs enable users to integrate, automate, and monitor receivables efficiently. Here's how each component works:

1. Contract Enforcement

-

Contracts in Flick Network are digitally enforced between participants, ensuring that payment terms, penalties, and service level agreements (SLAs) are honored.

-

Users can create, modify, and manage contracts via API, embedding automation into their receivables workflows.

2. Document Exchange

-

Businesses can exchange invoices, payment requests, and confirmations directly within the network.

-

APIs allow seamless integration with ERP systems, accounting platforms, and banks, ensuring documents are processed in real time.

3. Product or Service Exchange Validation

-

Payments are validated against deliveries—whether it's a physical product, SaaS subscription, or milestone-based service.

-

The network links invoices to fulfillment status, triggering payment obligations based on predefined conditions.

4. Contract Due Tracking & Automated Reminders

-

Every invoice and payment due is automatically tracked based on contractual obligations.

-

The system sends reminders, applies late fees, and escalates overdue payments according to network-defined rules.

5. Multi-Channel Payment Monitoring

-

Our Network monitors payment flows across multiple channels—bank transfers, digital wallets, corporate cards, and more.

-

APIs allow businesses to fetch real-time payment statuses, reconcile transactions, and detect anomalies in collections.

6. Payment Confirmation & Auto-Reconciliation

-

As payments flow through the network, they are automatically matched to corresponding invoices and contracts.

-

Confirmation updates are shared instantly across participants, ensuring financial accuracy and eliminating manual checks.

With Network APIs, businesses can create contracts, enforce SLAs, track payments, and automate collections—all within a unified, digitally connected ecosystem.