Payments Hub

One stop for all your payments channels

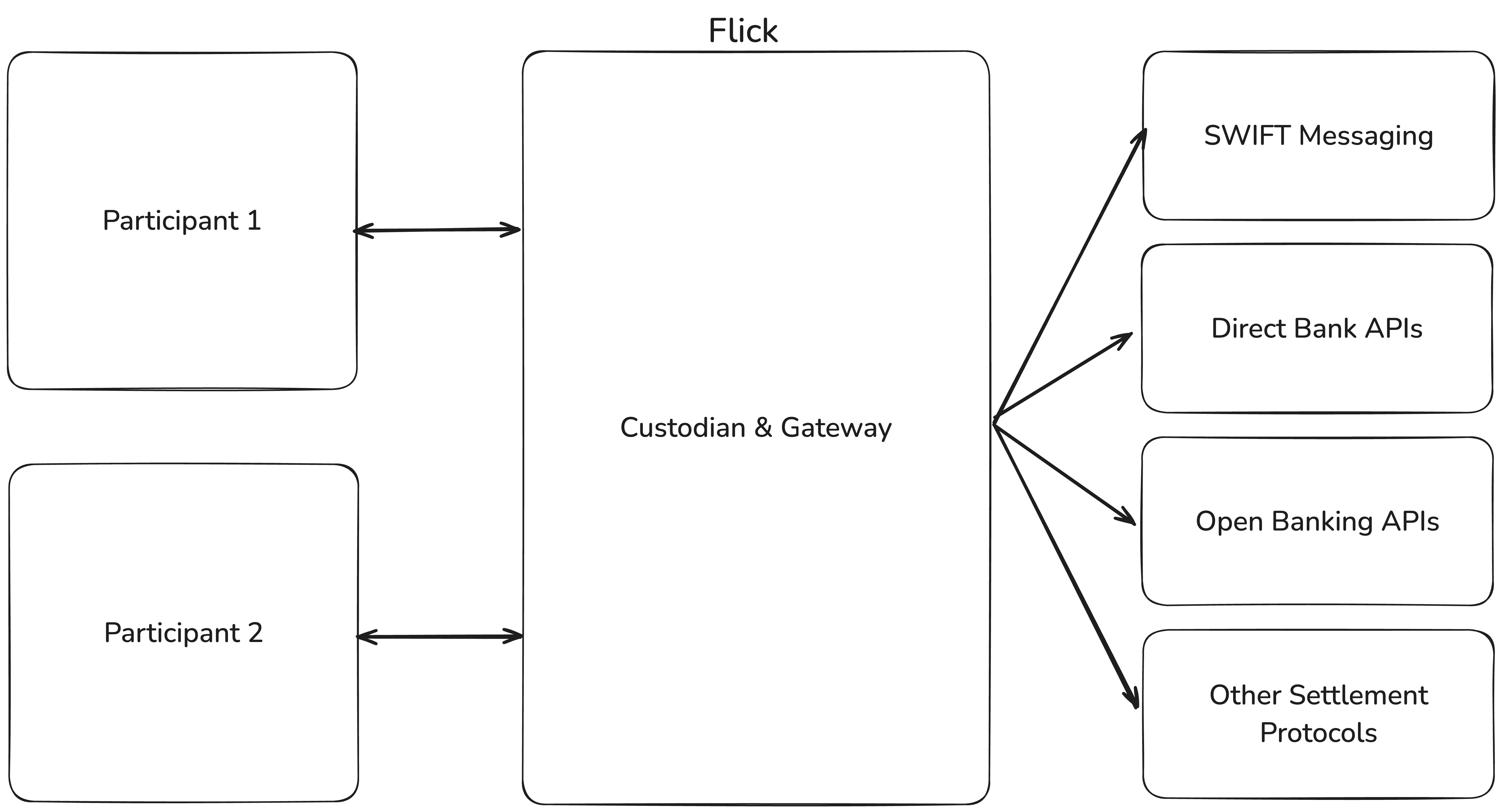

Our Network’s Payments Hub is an API-first payment infrastructure that gives businesses the ability to send, receive, and manage payments across multiple financial networks and payment rails—all through a single, unified API. Acting as the custodian of corporate wallets, this Network ensures secure fund management, real-time payment execution, and seamless global reach.

1. One API for All PaymentsCopied!

Instead of integrating with multiple financial institutions, businesses can use one API to access:

-

Bank-to-bank transfers via Open Banking.

-

SWIFT payments for cross-border transactions.

-

B2B payment connectors for corporate settlements.

-

Instant payments through regional clearing systems.

-

Wallet-to-wallet transfers for digital commerce.

-

Bulk and scheduled disbursements for payroll, supplier payments, and vendor settlements.

2. Custodian of Corporate WalletsCopied!

-

Our Network holds and manages corporate funds, acting as a secure payment custodian.

-

Businesses can pre-fund wallets and initiate controlled disbursements based on API triggers.

-

Supports multi-party wallets, where funds are stored, allocated, and settled programmatically.

3. Local & Cross-Border Payment CapabilitiesCopied!

This Network’s Payments Hub supports both domestic and international transactions, ensuring businesses can transact efficiently across regions:

-

SWIFT & Cross-Border Payments: Send funds globally with FX and multi-currency support.

-

SEPA (Europe), ACH (USA), FPS (UK), RTGS (Global): Leverage regional clearing networks for efficient payments.

-

Instant Payments (Faster Payments, UPI, etc.): Enable real-time transfers across supported countries.

-

Open Banking APIs: Directly initiate payments from bank accounts.

-

Local Clearing & Alternative Payment Methods: Support for country-specific rails for smooth regional transactions.

4. Secure & Programmable Payment ProcessingCopied!

-

Payments are triggered via secure API calls, ensuring full automation and reducing manual intervention.

-

Conditional payments can be enabled using escrow-like controls, ensuring funds are released only upon meeting predefined conditions.

-

Multi-level authorization allows businesses to define who can approve or execute payments via API workflows.

5. FX & Multi-Currency TransactionsCopied!

-

Businesses can send, receive, and convert funds in multiple currencies using the Network’s global payment infrastructure.

-

Supports competitive FX rates, allowing businesses to optimize international transactions.

6. End-to-End Transparency & ComplianceCopied!

-

Real-time payment tracking ensures businesses have full visibility over transactions.

-

Payments Hub follows regulatory compliance for AML, KYC, and cross-border financial regulations.

With our Network’s Payments Hub, businesses gain a scalable, API-driven solution that connects them to global and regional payment networks—simplifying fund movement, enhancing security, and enabling global expansion.